Subscribe to my free monthly newsletter:

Buying a car is one of the biggest steps towards independence. With it comes the ability to explore without having to meticulously study the train or bus schedule, and instead spend that time looking for a parking spot. But a lot of people don’t plan for the future when buying a car, they think too much in the short term and this can lead to major costs down the road. If you’re young and still in education then making an expensive mistake now could be the first domino that leads to many years of payments that put a dent in the bumper of your payslip.

I passed my driving test at the age of 17 however I put off buying a car until many years later, despite always wanting one. I love driving, there’s few things that are more enjoyable than feeling the acceleration, or cruising on an open road, but I always asked myself: “Do I need it?”. The answer, was no. I could not justify spending hundreds on insurance, fuel and upkeep on top of the up-front cost, just for a few day trips on weekends. As a student, I never particularly needed one for commuting either. If I needed to get around a city, I was happy to cycle and I always picked my student accommodation within walking distance of university. For some, it may be the case that the cost is a fair exchange in order for you to go out and explore and get around with more convenience. Either way, if you are buying a car soon, I think there are some things everyone should know.

Need or Want A Car?

The first thing to consider is whether you need to buy a car at all. In the United Kingdom, it is estimated that the average person spends £388.45 every month due to car ownership. If you reduced your yearly income by £4,600 and got given a car, would you take it? For young people, that figure could be even higher due to higher insurance costs. You may feel like you want a car because “that’s what people do”. That’s not a great mindset to have, you need to be doing what suits your situation.

Where to Look?

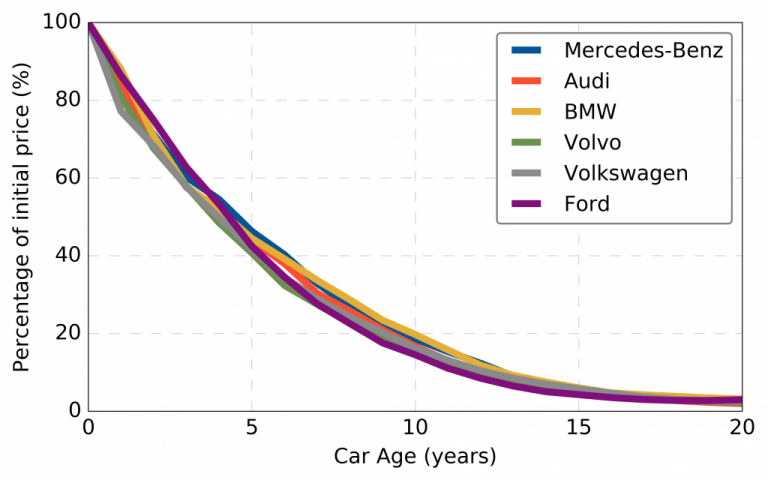

You have decided that you need a car, where do you start? If there is one thing you take from this post it is this: DON’T BUY BRAND NEW. It is not worth it, it will never be worth it. You’ve probably been told that a car’s value halves as soon as it is driven off the forecourt, and there is some truth to this. Cars devalue following an exponential decay, meaning that the yearly decrease in their value decreases each year, but the yearly decrease in value is greatest in the early years. The graph below demonstrates this.

Modern vehicle manufacturing is highly reliable. By setting a maximum age of about 7-10 years old, you reduce the risk of buying something that is on its last legs. You may be able to save an extra ~£500 to £1,000 by buying an older car, but you will end up paying more in the long term with repairs, higher running costs etc.

The next thing to consider is where to buy from. When I was first searching, I spent a lot of time going to a varied range of dealerships. I am in a position where I can do a basic inspection of the quality of a vehicle and I found that a lot of ‘back-alley’ dealerships had very poor cars. I would bet a lot of them would have needed a pick-up truck before you’d got it home. Anecdotally, having spoken to people who have purchased cars from back-alley dealerships their experience was as follows:

- The car breaks down so the new owner calls the dealer to inquire about the warranty that was provided

- The dealers wants nothing to do with it and says that the fault is due to the way the car was being driven (which is an exclusion in the warranty contract)

- The owner is left out of pocket and now needs to spend lots on repairs. The cost of fixing it probably outweighs any saving made by buying a cheap car

There is always a reason something is cheap. Supermarkets don’t sell off food in-date at reduced prices, do they?

My recommendation would be to use an official dealer. At first, I thought this would be too expensive, but the slightly increased price was worth it for receiving a full (and professional) MOT and service with a 12 or 6 month warranty. It is possible to find main dealers selling cars for around the £4,000 mark as well.

What To Look For?

You have just spotted a shiny looking car on the forecourt which is 20 % below what you would expect to be seeing, there’s not a single scratch on it, there must be a catch… surely. How can you tell?

- Age: I’ve already mentioned that age is important. I would set a maximum age of 7-10 years. Ultimately, things do start going wrong when a car gets really old. This can be mitigated by ensuring that you look after your car and getting it properly serviced each year. Those old cars you see on the road today, older than 20 years old, have probably been well looked after.

- Mileage: A conservative estimate of the ‘End of Life’ for a petrol engine is roughly 100,000 miles. You need to think ahead about how long you want this car, and how much you will use it. 50,000 miles on the clock would be a good purchase if you only do 5,000 miles a year and properly maintain it. Generally, a lower mileage is better as it means less wear and tear. However, if a car is 10 years old with only 1,000 miles on the clock, be way of two things:

- The car has been left stationary for a long time, which could lead to other problems

- Someone may have fiddled with the mileage reading

The final point on mileage, is something called a timing belt or a cam-belt. These wear out and can be expensive to replace. Not all cars have them though. Make sure you ask if a car does have one, and when it was last replaced

- MOT and Service History: Today, we are lucky that we can freely lookup the history of any vehicle. The seller should have any documentation about the service history, and you can find the complete MOT history for free here if you know the registration plate. You can also pay for more in-depth checks, but if you are buying from a reputable dealer, this shouldn’t be necessary.

What To Budget For?

There are many more costs associated with owning a car than just buying it. You need to be aware of how much it is going to be costing you (and perhaps compare this to what you are getting out of it).

- Emissions Based Tax: This is a tax that you pay based on how much of a polluter your car is. Typically, an older vehicles will have higher harmful emissions. Technology like stop-start technology reduces the tax you pay due to it reducing emissions. Look out for ‘Ecoboost’ or ‘EcoFlex’ or other similar catchy slogans, this means they are more efficient, and you will pay less tax. To find out what your tax will be, look at this table. Note that there is a large jump from £25 to £110 for vehicles that are above CO2 emissions of 75 grams per kilometre.

- Insurance: Always do a full insurance quote before purchasing. Some cars that I assumed would have cheap insurance sometimes cost about £250 more than others.

- MOT: This will be a standard flat rate at a garage. By checking the history you can get an idea of what often goes wrong with the make and model. Then, do some research to find out how much that costs to fix

- Service: This is another flat rate that is ideal to do yearly. Just a basic ~70 point check can do the world of good and find any minor issues before they become major problems

- Average Repairs: More generally, look at what often goes wrong with the make and model you are buying, and how much it costs to fix

- Fuel: Do an estimate on how many miles you think you will be driving, you will need to tell your insurance company this anyway. You can use this to budget how much fuel will cost you every month.

Don’t Buy What You Can’t Afford

Financing has become very common recently. A lot of people use it to ‘own’ cars that they simply can not afford. Financing will leave you financially worse off in the long term as the interest added on top of the monthly payments mean you end up paying a lot more than what the car was ever worth. It is also a contract you are stuck in. Unless there is 0 % interest, you should avoid financing a car. It is also good to scrap the idea of trying to keep up with appearances. If you’re just commuting to work each day, a sports car isn’t going to bring you much joy when you’re sat in traffic just like everyone else, and the fuel efficiency will burn a hole in your wallet. There are certain situations where financing is the only option available. If you do not have the cash to pay upfront, but desperately need one for work, financing may be your only option. This forms part of a vicious circle of debt. Financing a cheap car tends to come with higher interest rates too. If this is your only choice, try and see if there is a more affordable way to borrow the money, or re-assess if it is possible to make changes so that you do not need a car.

Pick Up Some Skills

Nowadays, many people don’t really understand how cars work. This isn’t really the consumers fault, they are more complex, with intricate electronics, and can often be difficult to actually get in to (looking at you – cars where you need to spend about 3 hours carefully removing parts just to change a headlight). However, if you have the time to, doing your own basic maintenance and repairs can save you a lot of money. Labour costs are a large part of going to a garage. A recent bill (under warranty, thankfully) came to me which was £80 for parts, £100 for initial diagnostics, and £250 for labour. It only took a day for the work to be done, too! Not all repairs will be possible to do yourself, but doing things like checking your oil, topping up fluids, or changing your own lights will mean less trips to the garage, keeping a few pounds in your pocket.

A final thing to say is that I am looking at this from a purely financial perspective. If you want to spend more on buying a sports car because that is what makes you happy, then I’m not suggesting you do anything other than that, and I don’t judge anyone for doing that. This post is for people who want to minimize their costs for buying a car. What was your first car, did it end up costing more than you thought?

Andrew

Subscribe to my free monthly newsletter:

-

Sunday Feb 7 2021

-

Wednesday Nov 18 2020

-

Wednesday Sep 9 2020