Subscribe to my free monthly newsletter:

In this article, I investigate what day is the best day to invest on. I do this by exploring any reasons why, and then creating a program that simulates long term weekly purchasing in a variety of markets and calculates which day had the overall best return on investment. To skip to the data, I collected on what day is the best, click here.

Retail investing has really hit it off, especially recently, with exciting chances to multiply your money by one hundred by investing in an old brick and mortar video game shop, and then lose it all the next week, it’s easy to see why it’s gained in popularity.

There are popular circles online of more risk averse, long term investors. These people look to invest in stable funds over a long period in time, favouring ‘time in the market’ over ‘timing in the market’. This is an investment strategy that I personally follow and a key aspect behind it is dollar cost averaging. In a nutshell, this is where you stagger your investments over a period, typically monthly, instead of investing all your capital at once. This reduces the impact of any market volatility. If you have a workplace pension, you probably already do this as the funds associated with your pension are purchased every time you get paid.

I have a monthly payment set up which invests in my chosen funds. This typically goes out on the same day (give or take a few taking into account weekends, bank holidays etc.) which got me thinking – does it matter when I choose to invest? I started to do a big of digging into any research which has already been done on this and found a few observations.

I Don’t Like Mondays

I will tell you why, too. Mustard Seed Money proposes some interesting thoughts about why Monday might be a bad day for stocks (i.e, they go down). They stated that bad news is reported on a Friday after market close to give people the weekend to forget or calm down. This is an interesting hypothesis, and it is shared by Investopedia which points towards a theory of people being down at having to return to work after the weekend. With such complex computer systems being involved in trading nowadays, I’m not sure anyone can point towards a justification for such a reason, or even if there is any statistical significance.

TGIF

Investopedia also hypothesised that Fridays are the best day to sell. I’m not going to go too much into this, because my article is focussed on long-term investing strategies which is going to involve a lot more buying than selling. But it’s interesting that Friday’s before a three-day weekend tend to perform better, suggesting that people’s feeling about their own lives can have some effect on the markets.

What Day is the Best to Invest on?

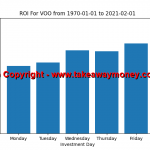

I wrote a program using Python and a module called pandas. It took the data of a specific stock or fund and simulated purchasing £100 or $100 every week, on a specific day. The program performs this for every week between a specified start and end date. At the end, it calculates the return on investment. Note there is no adjustment for inflation, but I do not think this should a problem, because it’s the return on investment as a percentage I am interested in, and this is independent of the amount invested. I performed this script on the following funds and stocks:

- American Airlines

- Apple

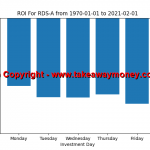

- Royal Dutch Shell A

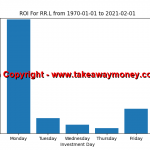

- Rolls-Royce

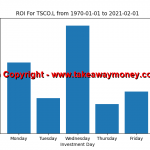

- Tesco

- Dow Jones Industrial

- NASDAQ

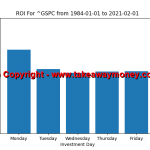

- S&P 500

- Vanguard S&P 500 ETF

- Hang Seng

- Nikki

- CAC 40

- DAX

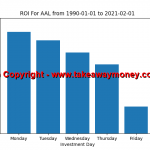

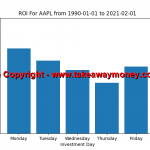

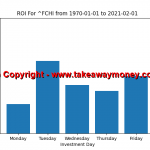

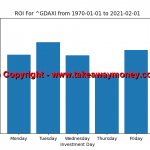

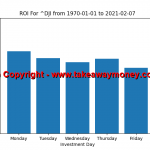

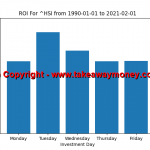

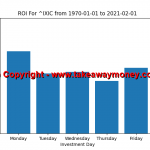

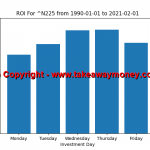

The graphs below show the day vs the return on investment. Click on a graph to see it enlarged.

First, let us look at the American markets: Dow Jones Industrial, NASDAQ, S&P 500 and the Vanguard S&P 500 ETF. There seems to be a trend towards the return on investment being higher on a Monday and the rest of the days are a bit of a mix-up. However, this trend is bucked by the Vanguard S&P 500 ETF which throws everything on its head with Friday being the best day and Monday being the worst. American companies follow this trend too, American Airlines and Apple show a trend for Monday performing the worst. American Airlines also shows a clear decrease for Fridays. Across the pond, in the United Kingdom, I chose Tesco, Rolls-Royce and Royal Dutch Shell. These are large companies employing thousands on employees throughout the United Kingdom. There is no clear day that can be deemed the best for these companies in the United Kingdom. Unfortunately, the Python module I was using didn’t like me trying to get data on the FTSE 100 so I had to choose a (rather unrepresentative) selection of UK stocks. The random nature is repeated throughout the Asian markets with the Hang Seng and Nikkei both throwing out random days. A final observation is a similar behaviour for the European markets as the CAC 40 (France) and the DAX (Germany) show Tuesdays being strong and an end of week revival on Fridays.

Conclusion

In conclusion, there are two things I’d like to say:

- Maybe the idea of ‘I hate Mondays’ and ‘TGIF’ attitude is a lot stronger in the United States than in Asia and Europe! It seems strange to me that there is a pattern in the United States markets which is not really mirrored anywhere else from my, admittedly limited, subset of markets.

- When dollar cost averaging, you are thinking for the long term. Overall, a few percent here and there is not going to make a difference after such a long time. When we look at the values being presented to us for markets, not just individual stocks, the numbers tend to be high, and the percentage difference between the return-on-investment values is very small. Personally, I do not worry about this sort of thing. The chances are that there is a big mix of random variation and human factors which determine what the best day to invest on is, and so trying to predict it goes against the dollar cost averaging strategy.

Do you choose a specific time of the month or week to invest? If so, what makes you choose that? I really enjoyed doing this little investigation and data analysis work. If you liked it too, you can subscribe to my newsletter where I update you on my latest articles.

Andrew

Subscribe to my free monthly newsletter:

-

Sunday Feb 7 2021

-

Wednesday Nov 18 2020

-

Wednesday Sep 9 2020